What sort of property taxes do I have to pay as a property owner and investor?

Find the answers to all your property tax questions here.

If you would like a personal consultation, contact us for a no-obligation chat.

Property tax is a tax on property ownership by the Inland Revenue Authority of Singapore (IRAS). It is applicable to all properties whether

- owner-occupied

- rented out

- left vacant

It is different from Income Tax where you pay taxes on income from renting out the property. If you lease out your property, you will pay both property tax and income tax.

Annual Value x Tax Rate = Property Tax

An Annual Value (AV) is the estimated annual rent of your property.

The AV is determined by the market monthly rent of your unit type after deducting for furniture, furnishing and maintenance fees, and multiplying it by 12. This market rate is based on transactions of similar or comparable properties within his development.

For eg, a property fetching an average of $4800 may have an AV of $3000 after allowances for furniture, furnishings or maintenance fee.

You can check your AV by logging into the IRAS website with your Singpass, select “Property” and “View Property Portfolio”.

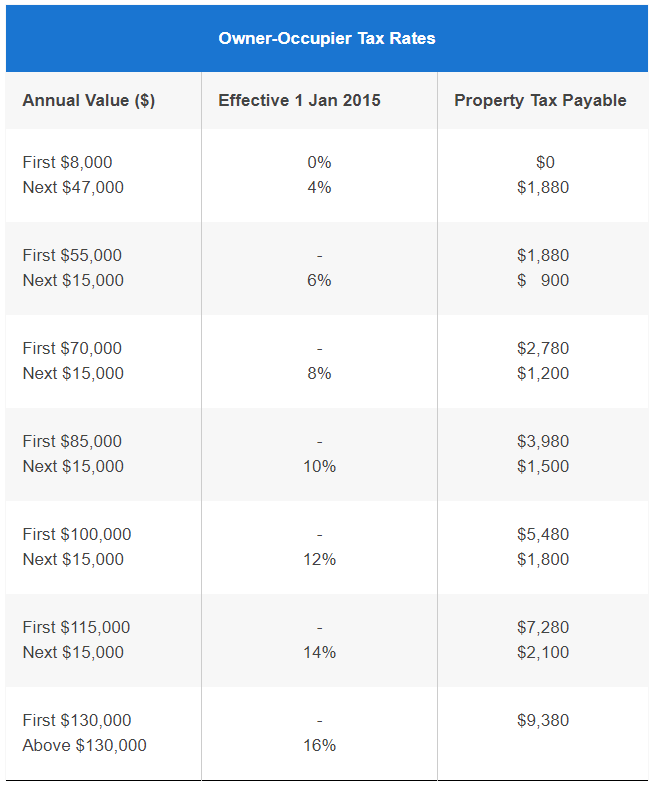

If you are living in the property, the Owner-Occupied Tax Rates apply to you.

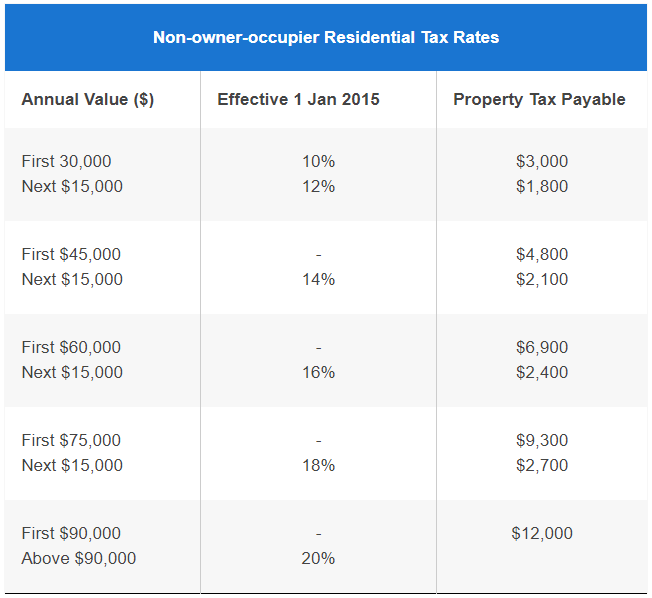

If you are renting out the property, or if the property is vacant, the Non-Owner-Occupied Tax Rates apply to you.

Non-residential properties (commercial and industrial) incur a flat rate of 10%.

Case Study:

You stay in a property with an AV of $36,000 after deducting for reasonable allowances:

For the first $8,000, you pay $0

For the next $28,000, you incur 4% rate = $1,120

Total payable = $1,120

Supposing you rent out the same property:

For the first $30,000, you incur 10% rate = $3,000

For the next $6,000, you incur 12% rate = $720

Total payable = $3,720

The due date is 31 Jan yearly. You will receive your tax bill at the end of each year.

If you do not agree with the AV of your property, you can challenge it by filing an appeal HERE.

Be ready to support your appeal with supporting documents regarding the market rental rates in your development. There is a fee of $50 for Owner-Occupied properties and $200 for Non-Owner-Occupied properties.

If you have financial difficulties, you can write in to IRAS to appeal. You may be allowed to pay in installments on a case-by-case basis.

We’re here to help you on your real estate journey.

Contact us using the form on this page and our Consultant will be in touch with you very soon.

Or contact us by phone/email.

Call: (+65) 8363 2331 / 8778 8778

WhatsApp: Glynis Tan / Benjamin Yeo

Email: findout@property-science.com